Home loans having solitary mom: Loan applications and you will guidelines

Are there mortgage brokers to possess solitary mothers?

If you’re there commonly specific unmarried moms and dad home loans, you will find several mortgage programs which can meet the needs from single moms and dads. These types of loans could help you circumvent the difficulty regarding straight down earnings when selecting a property as the just one mother or father.

There are also assistance applications that can offer money towards the your deposit, together with homebuyer training software and one-on-one counseling to help you from the home buying procedure. All in all, to shop for property since the a single moms and dad is generally much easier than just do you consider.

Obviously, there’s absolutely no particularly issue just like the good typical single moms and dad. Some are wealthy, although are working tough to juggle each other child care and you may its individual money.

When the money’s not an issue to you personally, along with an excellent 20% down payment toward family you need to purchase, it is possible to rating a normal financial (that maybe not supported by the federal government), provided your credit report is fit while lack also much current personal debt. Your following step is to find a loan provider you adore the fresh new appearance of then get preapproved for your mortgage.

However, life’s not like you to definitely for the majority unmarried mothers and fathers. You may find one money’s usually strict and this your own borrowing get takes occasional attacks. Still, your, too, becomes a citizen if you discover ideal financial support program.

Property conditions to own single moms and dads

Every lender may wish to be sure you can also be conveniently afford your own month-to-month mortgage repayments and the more expenditures that come with homeownership. Loan providers estimate that cost in the context of your existing month-to-month finances, using one thing entitled your debt-to-earnings proportion (DTI).

DTI measures up your monthly, pre-tax earnings facing your own constant costs – as well as your https://elitecashadvance.com/installment-loans-ok/miami/ coming home loan – to make sure you have sufficient earnings to support good mortgage repayment. Should your established bills along with your estimated mortgage payment is actually contained in this 43% of your own revenues, you need to be able to qualify for home financing.

Since importantly, you may need a good credit history, which could be from around 580 in order to 620 or maybe more created towards the minimum credit score standards on loan system you favor.

Unmarried parent lenders

If money’s a tiny tighter on your solitary earnings, you will be interested in an interest rate who’s looser eligibility conditions. Luckily, of numerous prominent mortgage software try versatile in this regard. Home buyers can select from a variety of lower and you may even zero-down-percentage lenders based on their needs.

Conforming loans (3% down)

Conforming financing are a type of old-fashioned mortgage that conforms in order to regulations placed down by Federal national mortgage association and you may Freddie Mac. You will need a down-payment regarding simply step 3% of the house price and you may a credit history out of 620 or best. However you will need to pay personal mortgage insurance coverage (PMI) up until you have attained 80% family guarantee

FHA funds (step 3.5% down)

Supported by the newest Government Housing Management, FHA financing has actually a minimal down-payment dependence on 3.5%. At 580, the credit score endurance is leaner than that have compliant loans. Remember that you can easily pay for financial insurance costs (MIP) if you do not promote, re-finance, or spend the money for amount borrowed in full. Therefore, of a lot buyers prefer a compliant mortgage if the their credit history is 620 or more

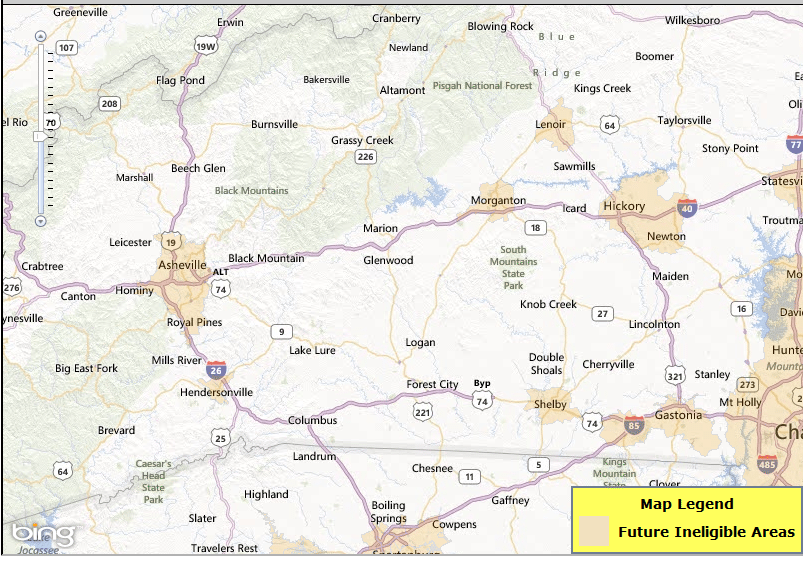

USDA financing (zero down)

USDA funds is actually backed by the latest You.S. Company away from Agriculture (USDA). Zero down-payment is needed. Nevertheless need get in the a designated outlying city (that has 97% out-of America’s landmass) and have the common or less than-average earnings towards the set the place you want it.