Calgary engineer, 32, will pay down an excellent $150,000 mortgage debt, money he accustomed purchase

With an interest price off perfect and 0.5 percentage items, James is actually investing $890 30 days to reduce this new $150,000 line of credit personal debt

Savings: $3,500 in the family savings; $57,one hundred thousand when you look at the TFSA; $80,100000 within the RRSP; $35,100000 during the dividend fund; $116,one hundred thousand in other non-inserted financial investments

Ideal monetary concern: Sooner I would ike to get a property but keep the brand new condo and you can book it out. Long-identity Allow me to are able to afford to call home a gentle later years.

James provides a constant life, inspite of the boom and bust character regarding his really works. A chemical professional employed in Alberta’s coal and oil sector, he is started with the exact same business over the past half a dozen many years. Because time, they are bought an apartment, built-up $291,five hundred in deals and you may visited European countries, China and South usa. They have the precise-work with type of pension and gets a yearly bonus from thirteen for each and every penny from their salary.

My mom is actually a good chartered accountant and you may my dad is actually good chartered monetary expert generally there are a good number of fiscal studies inside my domestic growing up, he says. Their moms and dads also have given him which have capital, giving him $450,000 purchasing good $540,000 condo for the Calgary for the 2013. The guy repaid the fresh $90,one hundred thousand financial for the past couple of years.

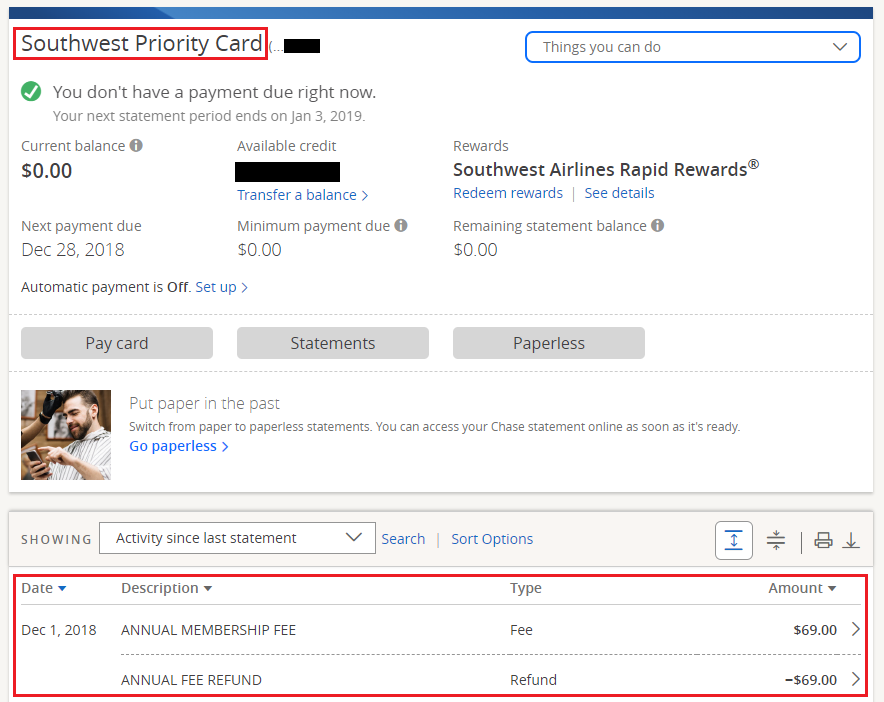

At the same time, James lent $150,100000 compliment of a property guarantee line of credit. The guy put some of those money because enjoy currency to acquire stocks a technique he understands was risky. He committed to crypto, tech and dividend stocks, and therefore didn’t excel during history year’s industry downturn.

I had a little liberal which have a line of credit my personal one objective is to pay that off, according to him. With an interest price regarding best in addition to 0.5 percentage affairs, he’s paying $890 1 month to reduce the debt. Each one of my personal opportunities are down now however, I understand one in the next 4-6 decades they will rebound to a point. According to him you to definitely in a worst-case circumstance, for example getting let go, however offer their investments and you can pay back new line of credit.

At the urging from their parents, James causes an authorized retirement savings bundle, hence, invested in shared money, already is at the $80,100000. According to him that he generally uses the newest RRSP to reduce his taxable income. The guy maxes aside each one of his tax-free checking account efforts. I’m wanting diverse, steady growth in my personal RRSP and you can TFSA, he says. The guy is served by $30,100000 inside the a bonus fund, money he spent when an earlier workplace paid down your exactly what the guy is due into the a retirement bundle.

James would like to get a detached assets. In the course of time I would ike to get a home but store this new condominium and you may lease it out, he says. Whether or not you to stays a feasible financial mission remains to be seen.

And you may he could be relying on their DB plan and his RRSPs having shelter in his golden years. Long-label I would ike to can pay for to call home a gentle old-age, according to him.

Their typical monthly expenditures:

$667 so you can TFSA. I be sure to top up my personal TFSA. I invest owing to RBC’s direct purchasing program specific is within Canadian bonus stocks, particular during the a company which makes quick atomic reactors and you will crypto expenditures.

$550 to help you condo costs. I got myself my personal condo preconstruction for the later 2013 and you will got palms into the 2016. It’s a two-bedroom, two-bathroom product that have a workplace. It is 850 sq ft and has a gym and you will backyard.

$163 on the car insurance. I have a great 2009 Subaru WRX hatchback I got myself it for the 2015. My spouse drives they over I actually do.

$one hundred for sites. I’m which have Telus. Its sometime high priced when i game a fair section. I enjoy Halo, Overwatch or Shooters toward Xbox 360 or Mario and you can Zelda to the Nintendo.

$85 on Netflix. This can include all news subscriptions including Disney+, Spotify, GamePass, YouTube Premium, Nebula, unsecured personal installment loans in Castle Patreon in addition to Industry.

$253 on the goods. That is my personal display of food. I store within Safeway otherwise Superstore. I go as a result of lots of carrots. We try to consume 75-per-cent vegan: chickpeas, rice, lentils, black kidney beans.

$425 into eating out. We eat away regular and when a sunday. We love Far eastern, Moroccan and you can Indian dining, hamburgers and you can pizza pie. We don’t purchase any longer than $60 simultaneously.

$244 into alcohol. I adore good highball, good gin and you will tonic otherwise whisky sours. I’ve whisky, rye, bourbon and Scotch. We strive and then make a good amount of cocktails in the home.

$fourteen to help you exercise application. Simple fact is that eight-time work-out it’s a circuit work out. I will do it from inside the a hotel room.

$29 towards the sporting events. I was skiing since i have try 5. We would three sunday skiing travel for each season to help you locations such as for example Lake Louise or Revelstoke.

$5 into the courses. I always score Indigo current cards having my birthday otherwise Christmas so i cannot generally speaking budget for so it.

$618 on getaways. We attempt to travel worldwide two months a-year. We will would a family group a vacation to The state. My personal moms and dads enjoys a put in Hand Springs.

Total: $6643

*Some facts are converted to cover the fresh new privacy of one’s person profiled. We should thank him getting sharing their story. Are you presently an effective millennial or Gen Z who would like to participate in an excellent Paycheque Project? Send us an e-send.

Have you been an early on Canadian that have money on the head? Setting your self up for success and prevent high priced mistakes, hear our award-winning Stress Shot podcast.