The debt-to-money ratio: Their citation to financing approval and lower rates

Unless you’re independently rich, major orders-eg vehicles and you may homes-calls for trying out some kind of obligations. Yet not, you to definitely financial obligation is about to realize your up to. Every time you get financing down the road, whether it is a small personal loan or a big home loan, the lender will want to recognize how far obligations you’ve got in line with your revenue.

Your debt-to-earnings ratio (DTI) procedures their month-to-month obligations money in accordance with the month-to-month income. It does provides a giant effect on if or not you get approved for a financial loan while the rate of interest you wind up that have-determining just how much the borrowed funds can cost you. Let’s read this way of measuring your debt, plus tips assess the debt-to-money ratio and its particular influence on your finances.

Key points

- Your debt-to-earnings proportion reflects just how much of your income are taken up of the financial obligation money.

- Information your debt-to-money ratio makes it possible to reduce personal debt while having better conditions after.

- Using a guideline (including the qualifying proportion) can help you assess the probability of acquiring the ideal mortgage words.

What is the financial obligation-to-income proportion?

The debt-to-earnings ratio is actually shown because a percentage of one’s monthly personal debt money when compared with the month-to-month gross income. If you have a DTI off twenty-five%, it indicates one 25 % of your monthly pre-income tax income will be regularly build minimal repayments on the expense.

The DTI cannot always include more income you put on the personal debt cost. Instead, the DTI compares your disgusting (pre-tax) earnings and also the minimum costs you happen to be needed to create because you maintain your account inside a standing.

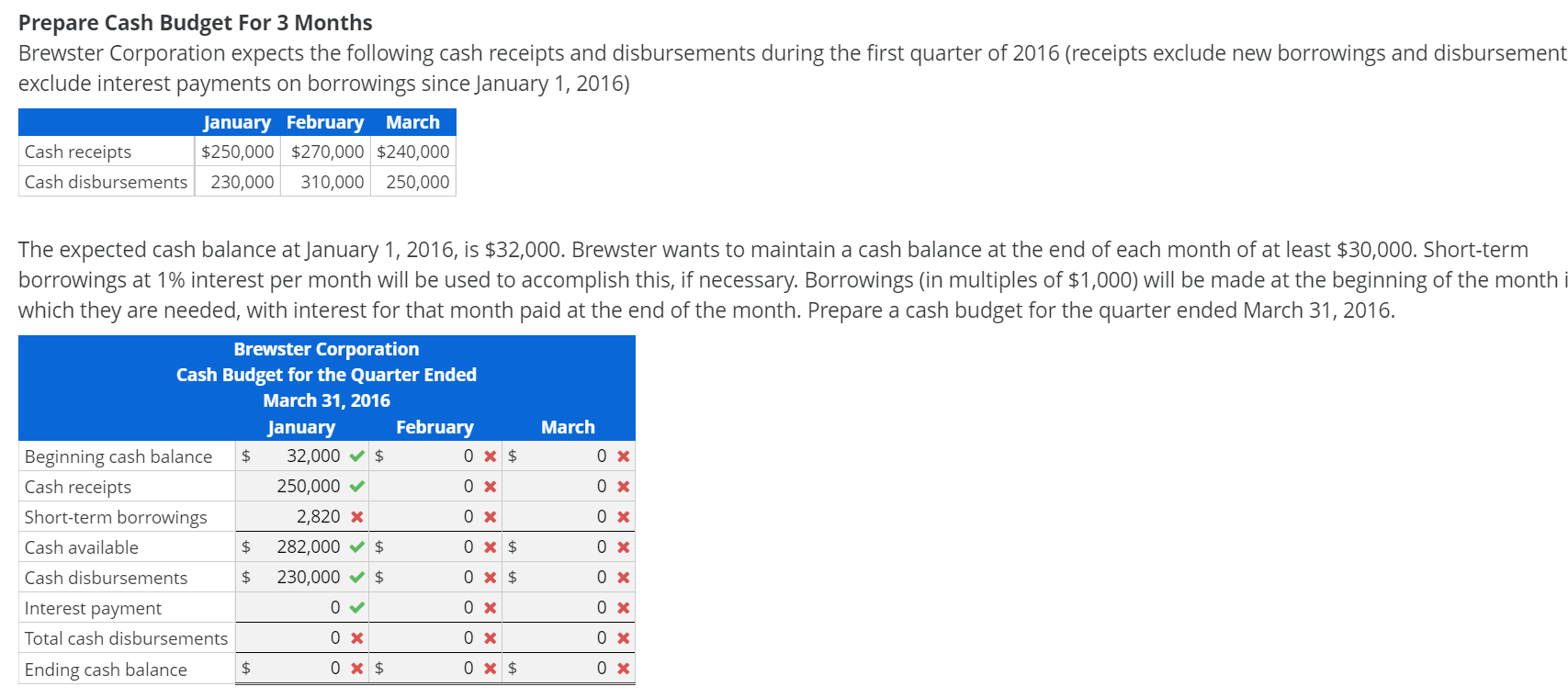

How-to calculate the debt-to-earnings proportion

Figuring the debt-to-income proportion is pretty simple. Begin by looking at the gross income. 2nd, add up any lowest repayments. Separate the full of your own lowest repayments by the gross income and proliferate you to by the 100 to get your DTI.

Instance, guess you create $forty eight,000 a-year ($4,000 thirty day period). You’ve got the pursuing the fund into following the monthly payments:

- Car loan: $450

- Personal loan: $2 hundred

- Education loan: $250

- Mastercard minimum percentage: $35

- Next credit card lowest fee: $55

The month-to-month obligations payments total up to $990. For people who divide $990 by your terrible month-to-month income away from $cuatro,000, you earn 0.2475. Multiply that of the 100 getting a DTI away from %. For people who locate, you could imagine that the debt-to-earnings proportion try twenty five%.

Exactly how your DTI has an effect on financing and you will credit recognition

Your debt-to-income ratio can affect the loan and you will borrowing from the bank recognition as lenders make an effort to determine whether you’ll generate costs. In the event your DTI is just too large, a lender might be reluctant to financing your additional money, alarmed that your particular financial obligation costs will become extreme for the finances.

I’ve bad credit. What makes my personal rate of interest so high?

Cash is strict on your domestic, and you may financial institutions perform by … and come up with your daily life costly? Will not appear fair, does it?

- New heading rate into the a similar benchmark, such a beneficial Treasury thread.

- The right your borrower could make all the desire and you will principal money (as opposed to standard towards the loans).

The better your risk of default, the more the financial institution will want https://simplycashadvance.net/title-loans-ky/ in the desire since compensation getting the extra chance they’re delivering of the loaning for your requirements.

Exactly how is risk assessed? On home field, it’s your credit rating. About securities business, its as a result of thread credit scores.

When you’re acknowledged despite a premier personal debt-to-income proportion, you might find yourself paying increased interest rate. You will probably shell out a lot more overall towards loan. However, by lowering your DTI, you can enhance your odds of providing financing regarding the future-and you can save on attention costs.