Favor Va Bank to have Virtual assistant Mortgage To build A home

- You are a working service user that have at the very least 90 days off effective responsibility provider.

- You are a seasoned having offered at the very least 181 months of energetic obligations service.

- You are a recent National Protect representative who has supported at least six age.

- You are a released Federal Guard affiliate who has got served within minimum six age.

- Youre a national Guard otherwise Reserves associate who has been entitled to help you active duty and you can supported ninety days from energetic provider.

- You are a great widowed and you can us-remarried armed forces mate whoever companion enjoys died about distinctive line of responsibility or due to an assistance-relevant burns. (You will need to promote proof their Dependency and you can Indemnity compensation).

Virtual assistant Design Financing Borrowing Conditions

The fresh Virtual assistant framework mortgage includes lenient borrowing requirements as compared to traditional financing, putting some loan a whole lot more accessible to experts having lower fico scores. This is why experts without optimum credit ratings will have the ability to view Va design loans.

- 620 Minimal Qualifying Fico scores for all being qualified borrowers

- 620-659: No less than dos qualifying credit ratings are essential for everyone qualifying borrowers. Make use of the middle score when the step 3 fico scores or perhaps the straight down of these two if the dos credit scores.

- 660+: At least step one qualifying credit history needs for everybody consumers.

- The lowest associate rating of all the consumers is used in the new certification processes.

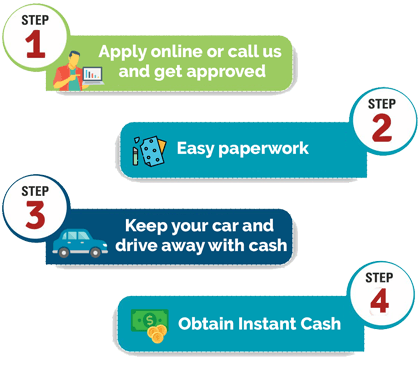

Virtual assistant Design Mortgage Processes

The fresh Virtual assistant construction mortgage techniques is fairly simple, providing you feel the assistance of a Virtual assistant financing officer who’ll assist you compliment of each step of the process throughout the mortgage techniques. To begin on the software getting good Virtual assistant design loan, contact Safeguards handy link The united states Financial today!

Prove Eligibility and Entitlement

The initial step throughout the Virtual assistant framework mortgage process are acquiring your qualifications certification. You could potentially see your certificate regarding qualifications with ease by using the COE application form into the the webpages. Our very own use of new LGY system function we can help you get qualification certificate inside the moments.

Attempt to register the services of a skilled Va bank like Coverage America Mortgage and you can an experienced Virtual assistant loan officer to greatly help make suggestions from application for the loan, procedure and you can closing of the Virtual assistant design financing. During the Safety The united states Financial, i make an effort to result in the mortgage process fret-100 % free. Cover The united states Mortgage has the benefit of Va build funds which have a hands-on the financing administrator and individualized sense for the cherished seasoned consumers.

Look for Virtual assistant-Recognized Builder

You need to use an excellent Virtual assistant-acknowledged creator about Virtual assistant structure loan process. For people who curently have a covered builder in your mind, get hold of your Va financial and get them to help you to get your creator joined with these people too. This new Virtual assistant in addition to lender both agree developers.

You can find Virtual assistant-accepted builders using our very own representative-friendly Va-accepted builders chart, which will help you can see a builder close by. Otherwise, you can make use of the brand new Veterans Circumstances website to verify that an effective creator is actually joined to your Virtual assistant.

Just because a creator is actually joined into the Virtual assistant doesn’t imply that we will approve them on Safeguards The united states Mortgage.

Over Possessions Appraisal

The bank often register the help of an assessment pro throughout the the fresh new Virtual assistant construction loan application techniques. The fresh new Virtual assistant lender requires an exact really worth depicting new completed residence’s really worth, as they possibly can maybe not lend over that it really worth. The latest assessment will also help new Va bank make certain you was not-being overcharged into structure of the home.

Construction

Closing for the Virtual assistant structure money usually takes off 30-two months to close off according to factors instance that have builder preparations, the residential property reputation, brand new developers acceptance along with your acceptance. There clearly was a change from 5 days up to good seasons to construct. one year ‘s the maximum greet. After you’ve closed into the loan, framework may start. You’re not needed to make repayments into a good Va design loan up until the build phase is complete and you have a certification away from occupancy.