Designed capital options one make toward FHLB financing chance

Borrowing chance\r\letter Just like any investment, the worth of a fixed earnings cover could possibly get decline. Concurrently, the latest issuer otherwise guarantor of the defense could possibly get neglect to pay attention otherwise prominent whenever owed, as a result of adverse alter into the issuer’s otherwise guarantor’s economic situation and/or company. Typically, lower-ranked securities hold a greater standard of borrowing risk than just large-ranked ties.

Security risk\r\letter The new regards to for every FHLB mortgage have a tendency to dictate the desired guarantee conditions, but if the worth of the fresh new guarantee was to drop significantly, the insurance coverage organization borrower may prefer to post even more equity.

Operating collaboratively having insurance companies, i have created https://simplycashadvance.net/personal-loans-nv/ funding options having personalized objectives and you may chance profiles that seek to exploit brand new FHLB credit solution. Profile 7 has analogy profiles that demonstrate just how an enthusiastic insurance company might pertain this concept. The repaired-price credit instances (revealed within the dark blue) of a few-, five-, seven-, and you can ten-season terms, correspondingly, for every single were an excellent hypothetical collection from 100% corporates matched up so you can repaired-rates loans with an installment away from an effective treasury rates and additionally a spread. New floating-price lending analogy (shown into the light blue) was a 100% CLO profile compared against a floating-rates financing with an effective four-season identity and it has a cost of SOFR including a spread. On occasion, this new FHLB also offers finance prepayable by insurance carrier, and that we quite often highly recommend due to the restricted costs and increased autonomy.

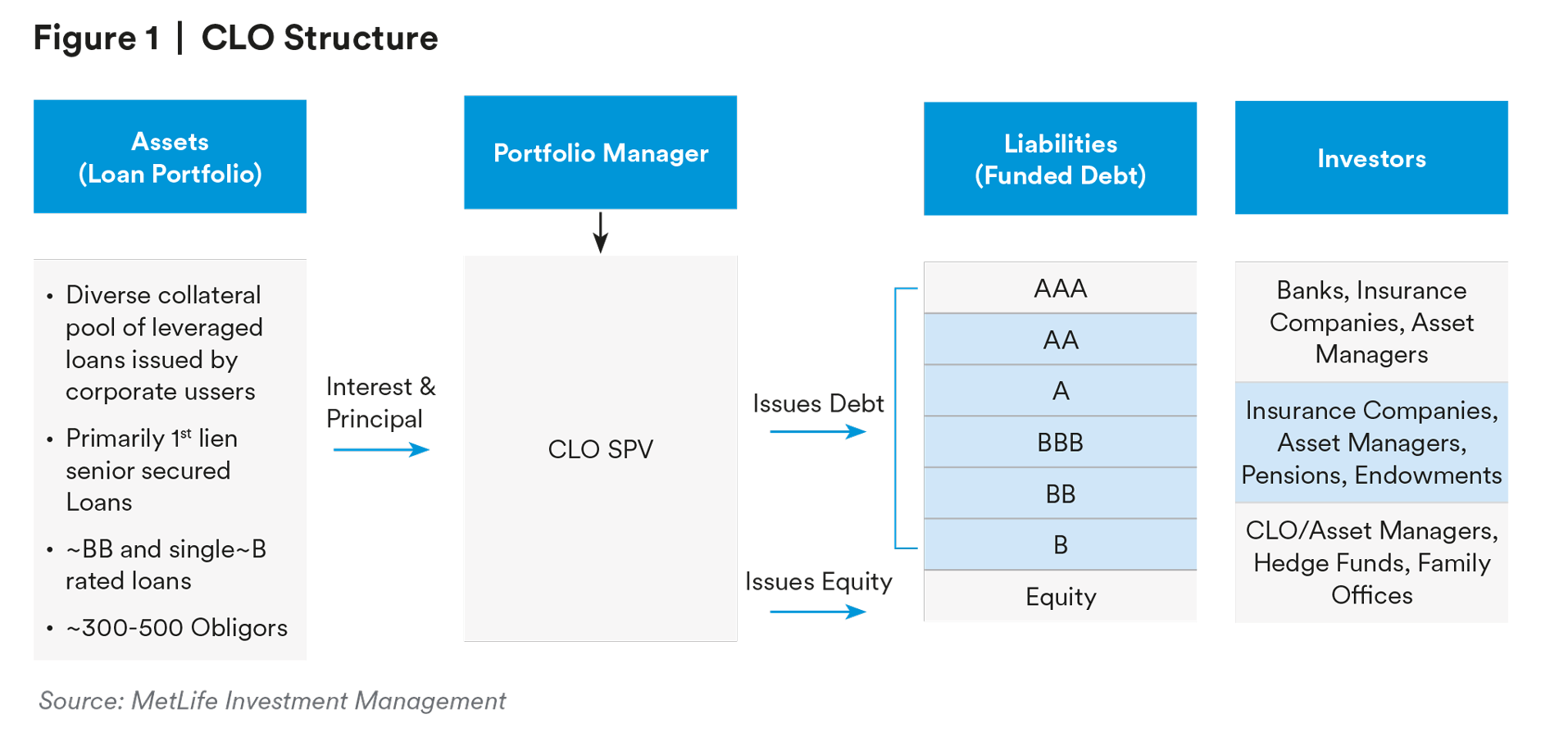

These types of example portfolios imagine NRSRO and you may score agency advice in regards to so you’re able to exchangeability and top quality considerations. Usually, we come across the quintessential use in the floating-rates progress options. It’s been driven because of the beauty of CLOs in accordance with most other investment-degree asset groups, due to the fact 100% CLO portfolio typically gift suggestions an informed arbitrage opportunity. Into the CLO portfolios, we have seen a mix of borrowing risk ranging from 100% AAAs so you can a variety of A great otherwise finest (since the found inside Profile 8). Certain customers features opted for broader securitized profiles using other floating-price property like Unmarried House Single Debtor industrial financial-backed securities (CMBS). Recently we come across an uptick when you look at the need for prolonged years (

10 year) fixed-speed loans provided its glamorous pass on as well as the possibility to lock into the reduced financing cost for quite some time of your energy. This new trend inside fixed-speed fund has been towards 100% corporate credit because the which market greatest increases the brand new arbitrage, however, launching other credit sectors such securitized or taxable municipals could further raise bequeath.

Ultimately, regulating standards of fifty states are too varied to deal with here but is highly recommended in the framework of your money collection and you will practical bequeath purpose. Capital professionals and you can consultants try ably positioned to help with this town.

Using FHLB improves to possibly promote produce/build alpha: Key considerations

Drawing on the all of our experience in setting up these types of mandates which have insurance subscribers, we recommend additional things to consider:

It’s important to plan the fresh new tranches of cash streams when you look at the accordance which have how quickly the bucks can actually become invested with the this asset class; let me reveal it’s always best to stop looking at bucks while you are repaying interest towards an upfront

step one. Sizing of your own improve and complete FHLB capacity was limited from the the degree of qualified collateral that is available so you can vow. Of several insurance firms take care of free borrowing convenience of crisis liquidity objectives.

step 3. Establishing clear and you will full assistance to possess give-enhancement facts is additionally crucial, within our check. Along with a liquidity parts and you can explicitly addressing almost every other standards to own meeting regulatory and studies-institution limits can have demostrated purpose to help you regulators and have now create a great obvious structure on the money director.