8 Wise Techniques to Lower your Mortgage EMIs

What’s the qualification having home financing?

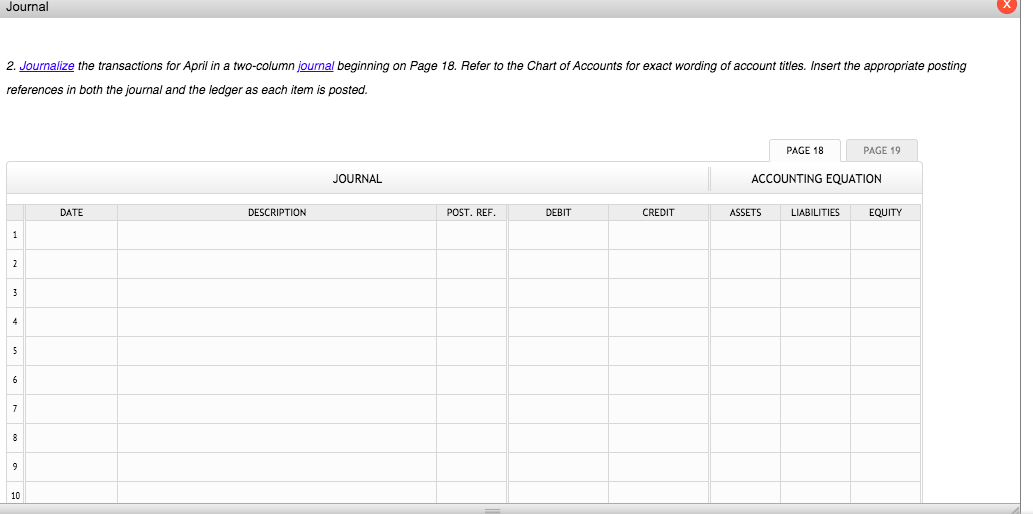

Qualifications to possess home financing basically depends on numerous important aspects in addition to years, income, a position position, credit rating, debt-to-money ratio, value of, loan-to-really worth ratio, and deposit. People need generally feel about 18 years old and you may show secure money and you may a position records, having salaried anyone in need of a couple of years regarding proceeded a position and you will self-functioning individuals proving consistent money due to tax statements and you can business financials. A good credit score is extremely important since it has an effect on financing recognition and you will rates. Lenders in addition to measure the loans-to-money ratio, preferring that it is significantly less than thirty-six-40%. The mortgage number always depends on this new appraised worth of the new possessions, with a lot of lenders hiding so you can 80-90% for the worthy of, requiring brand new borrower making a down-payment, usually around 20%. Even more considerations start around new borrower’s residency condition and particular financial standards.

Just how much do you really use regarding the lender?

Extent you might borrow away from a lender to own a home financing relies on numerous things, primarily your income, the worth of the house or property you intend to pick, along with your credit history. Here you will find the key aspects one dictate how much cash you can borrow:

- Income and Personal debt-to-Money Ratio: Financial institutions typically have fun with a beneficial multiplier of one’s disgusting yearly money in order to determine how far you might borrow, have a tendency to ranging from three to five minutes your yearly earnings. That it depends on the debt-to-income proportion, that’s a way of measuring your own overall monthly bills split because of the your monthly money. Most finance companies choose which ratio are lower than thirty six% in order to forty%.

- Loan-to-Well worth Ratio (LTV): This is the percentage of the fresh property’s worthy of the bank is actually ready to finance. Such as, when the a bank provides a keen LTV proportion from 80%, and property is appreciated within $100,000, the financial institution do give doing $80,000.

- Credit rating: A higher credit history can also be change your eligibility to own more substantial loan amount since it indicates towards bank that you are a lesser-risk debtor.A position Updates: Steady work and you will an established source of income assures loan providers regarding your capability to repay the mortgage, potentially increasing the count he could be prepared to lend.

- Down-payment: What kind of cash you could shell out upfront since an all the way down percentage and additionally influences how much you can use. A larger down-payment reduces the loan amount therefore the chance for the financial.

8 Smart A method to Lower your Home loan EMIs

Owning a home commonly gets the difficulty away from controlling large financial EMIs. If you are such costs are one step to your dream home, capable be also a serious monetary burden. The good news is, there are lots of wise methods you might utilize to attenuate your own mortgage EMIs. Whether you’re a special resident otherwise halfway during your mortgage tenure, learning how to decrease your home loan EMIs could save you a significant amount of currency.

1. Help the Tenure of your Financing

Extending the loan period will reduce the newest monthly installments. But not, just remember that , although this minimizes your own EMIs, it raises the desire paid down across the life of new mortgage.

2. Create a limited Prepayment

When you have a little extra money, to make a limited prepayment can aid in reducing the principal amount, which in turn can lessen your own EMIs or mortgage tenure. Very financial institutions do not charge a fee to own limited prepayments.

3. Equilibrium Import The loan

If rates of interest provides dropped as you grabbed the loan or in the event your credit score enjoys enhanced, imagine refinancing the loan. A lower interest is also notably slow down the emi of present financial.

4. Choose for a mortgage with a lower life expectancy Interest

Search and you can compare individuals financing available options on the market. Specific banks can offer fund during the relatively down interest levels.

5. Negotiate together with your Latest Bank

When you yourself have good repayment records, you might be able to discuss a far greater interest with your financial.

6. Change to a different sort of Rate of interest

For those who have a fixed-price loan, envision switching to a floating speed, or vice versa, based that’s a lot more advantageous considering current market conditions.

7. Comment and you can Maximize your Funds

Sometimes, how you can carry out higher EMIs is by optimizing the monthly finances and you may minimizing unnecessary expenditures.

8. Play with home financing EMI Calculator

Managing home loan EMIs doesn’t have to be a stressful activity. By adopting these wise steps, you might reduce the load of your own EMIs and work out the happen to be managing your ideal domestic a warmer and you will financially tone. Think of, for each approach is sold with its own number of positives and negatives, and that which works greatest hinges on your financial situation. It is usually a good idea to speak with a monetary mentor to have custom guidance tailored towards particular factors.

Faq’s about Reduce your Financial EMIs

Points you to influence the EMI from a mortgage:1.Loan amount: A top loan amount leads to large EMIs.2.Interest: A top interest leads to highest EMIs.step 3.Financing Period: Prolonged tenures cause all the way down EMIs, however pay a lot more notice over time.4.Sort of Rate of interest: Repaired otherwise drifting rates connect with EMI computations in different ways.5.Running Costs: Additional fees can increase all round cost of the borrowed funds.

Basically, initially, drifting costs can offer straight down EMIs compared to repaired prices. However, drifting costs can change throughout the years, which means your EMI could possibly get raise in the event that rates go up.

There are around three biggest a method to lower your mortgage emi1.Favor an extended period to lower EMIs, but that it increases the overall attention paid down.2.You can refinance the borrowed funds in the a lesser interest rate in the event that you’ll.step three.Generate a hefty prepayment to reduce the principal count.

step one.Improve the loan period to own down monthly premiums.dos.Decide for a lowered amount borrowed if possible.3.Negotiate to have a reduced interest.

EMI against. Period loans Sheffield AL Reduction:step one.Cutting EMI is very effective having instant cash flow.2.Reducing tenure conserves to the complete interest repayments however, increases the month-to-month EMI.

Of a lot finance companies allow it to be prepayments to minimize the principal amount, that will effortlessly reduce the tenure and EMI. You can examine your loan arrangement to own prepayment conditions and terms.

Techniques for paying home financing intelligently:1.Consider making unexpected swelling-contribution payments.2.Use windfalls such as for example bonuses otherwise tax refunds and work out prepayments.step 3.Maintain a good credit score to help you negotiate lower rates of interest otherwise refinance the loan.4.Talk about mortgage consolidation alternatives when you yourself have several money.