An enthusiastic overdraft is a means of borrowing on your family savings

Overdrafts are offered on your latest account in order that, if your balance is actually no, you could potentially nevertheless invest doing an arranged maximum. Overdrafts normally have a top rate of interest than just signature loans however, is versatile and can be useful to have quick-title credit and you will apparently lower amounts.

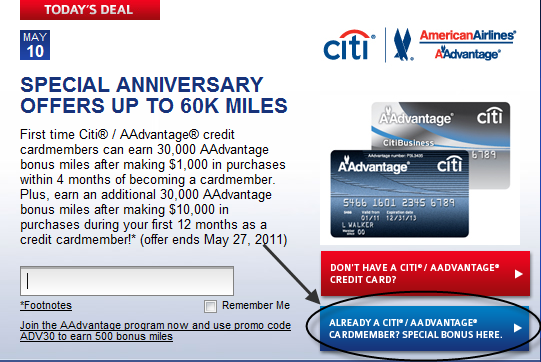

Handmade cards

Credit cards makes you obtain a limited amount to pay money for goods and services. There isn’t any desire recharged towards borrowings for people who shell out your own complete costs inside a set amount of weeks.

Handmade cards are versatile and can be employed to need loan for credit score 500 pay for activities and you will qualities that you may possibly pick on line otherwise from the cell phone. Playing cards is acknowledged to cover goods and services otherwise to locate cash.

New CCPC has a charge card analysis unit that presents the fresh rates energized for various credit cards that are available.

Signature loans of banking institutions

Banking companies render signature loans so you’re able to people. These types of financing are suitable for average and prolonged-label means, such as, a car loan or a loan having renovations. Banking institutions may fees most other fees. Essentially, you only pay a fixed number straight back monthly.

In the event the financing are a changeable rate mortgage you will be capable spend even more back when you have got they, so that you can pay-off the mortgage ultimately.

Borrowing from the bank union money

Borrowing unions also offer money so you can people. You must be a person in a credit commitment one which just may take away that loan. Borrowing from the bank unions is actually found in the society or work environment and also you must be life or doing work in a specific city or operating for a specific workplace to become a part. You may need to have stored some money into the a credit relationship before getting a loan.

Borrowing from the bank union finance is suitable for short or lengthened-title need such fund to have getaways otherwise cars. They are also useful for refinancing almost every other loans.

Specific borrowing unions offer the It seems sensible mortgage. It mortgage is aimed at anyone bringing societal passion money just who pay back the borrowed funds through the House Finances Scheme. It’s got loans out-of lower amounts on low interest rates.

Hire purchase

This is exactly a get agreement given by shops so you is also hire and in the end pick version of products. Products purchased towards hire purchase are typically expensive points eg a motor vehicle or chairs otherwise digital devices. From inside the a hire-purchase contract, you become the owner of the item if the history instalment are repaid.

Personal Offer Arrangements (PCPs)

This is exactly a kind of hire-purchase contract offered by automobile investors in an effort to purchase a car or truck. In a great PCP bargain, you have to pay in initial deposit and always make regular instalments, always over 3 years. There is certainly constantly a big lump sum payment at the end of the price.

- Spend the money for last lump sum and keep the vehicle otherwise

- Come back the automobile for the merchant

You don’t very own the automobile through to the last commission is generated. For people who come back the car, you could take-out a unique PCP for the yet another vehicle.

PCPs can appear very attractive as they often have really low month-to-month repayments nevertheless they can be cutting-edge as compared to other forms regarding auto loan. It is very important see all fine print just before your register for an effective PCP. You can find out a lot more about PCPs regarding CCPC.

In-store borrowing from the bank

Some shop give you the option to purchase a product and you may spend for this within the instalments. This is exactly sometimes named Pick Today Spend Later.

Your enter into a binding agreement to settle the financing provider. It is important to read the small print of the contract, like the costs and you may charges particularly interest otherwise late commission charges. The fresh new CCPC has further information towards Pick Today Shell out Later on.