Exactly how much can i use which have a property guarantee financing?

Ask loan providers about their assessment conditions once you begin wanting property equity mortgage to know about their timelines. If you had an assessment carried out in the last year or several, a loan provider you are going to accept is as true, regardless if that isn’t secured.

The best way to speed up your property equity loan procedure is always to stick to the top of software steps. Submit all your payday loan La Jara valuable documents as quickly as possible, and you will act quickly to any questions out of your bank. This will help to prevent technical hangups that could slow down new closing.

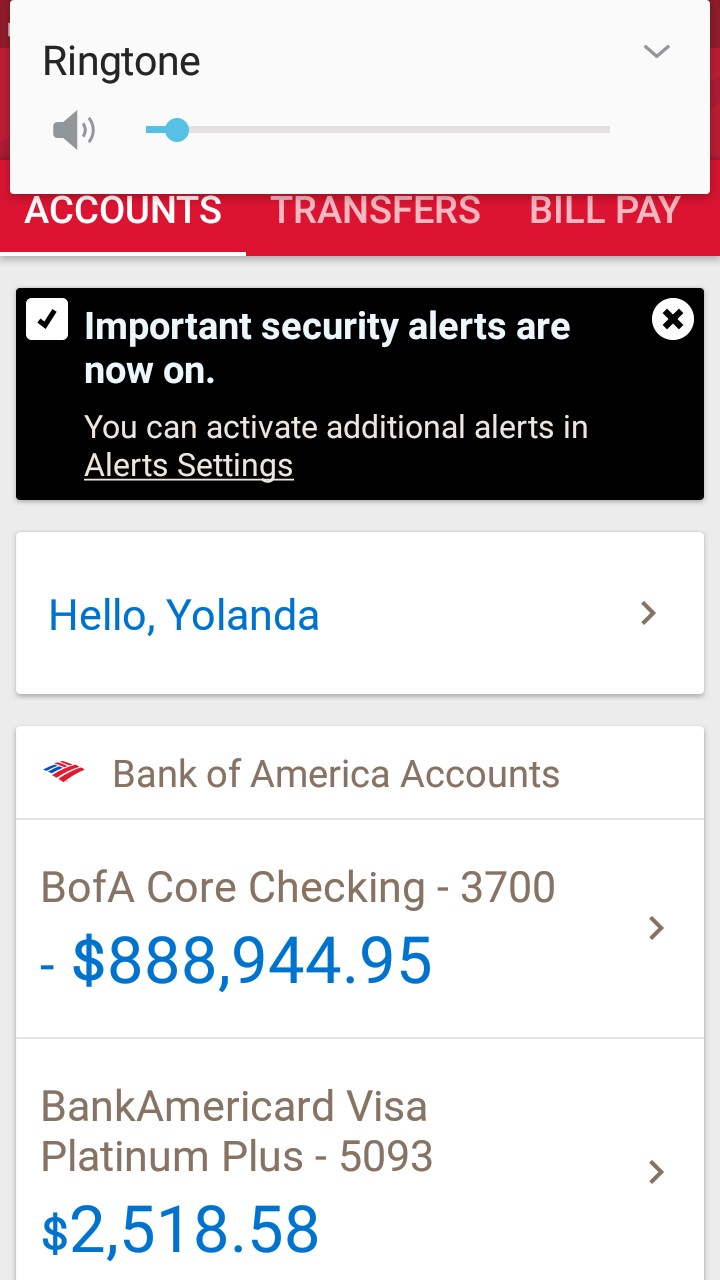

For those who be eligible for a house equity mortgage, you might generally use up to 80% of your own value of your property, minus one outstanding financial personal debt. That means you would like more 20% security accumulated to find approval.

You should use survey internet [like] Zillow to find a concept of the residence’s latest well worth and accumulated collateral, ways Michael Hausam, a large financial company and you will Real estate agent. Remember that online prices aren’t 100 % specific.

Once you’ve roughly computed your home collateral value, multiply it from the 80% to obtain the restrict amount you could potentially obtain within number one and you may 2nd mortgage loans. Upcoming deduct your current financing balance so you’re able to guess the limit house collateral amount borrowed. Eg:

- Family worthy of: $five-hundred,000

- Latest mortgage balance: $250,000

- Limitation full credit matter: $eight hundred,000 (80% out of house worthy of)

- Subtract current mortgage debt to acquire your house guarantee loan amount

- Restrict house equity financing: $150,000 ($eight hundred,000$250,000)

Not absolutely all people can be use a complete quantity of security offered. The loan amount utilizes your credit rating and financial situation. Simultaneously, withdrawing more of your guarantee can cause high interest rates.

Domestic collateral financing standards

You will need to meet loads of key family collateral loan requirements if you’d like to qualify. They are having adequate domestic security, keeping a reasonable loans-to-earnings proportion, appearing a good credit score, bringing economic documentation, and having finance for settlement costs.

Enough household guarantee

An essential dependence on property guarantee loan is you have sufficient equity of your house. The newest security in your home is determined of the subtracting your own outstanding financial harmony from the property’s current market really worth.

To choose whether or not your meet up with the equity conditions, loan providers generally speaking fool around with metrics such as the mortgage-to-worthy of proportion (the mortgage balance in accordance with the worth of your home) additionally the joint financing-to-really worth ratio (CLTV, which makes up about the financing towards the property). Lenders generally approve house collateral fund with a keen LTV or CLTV all the way to 85%.

Sensible financial obligation-to-earnings proportion

Once you sign up for a property collateral financing, loan providers will at the debt-to-earnings (DTI) ratio. So it fee proportion represents the monthly debt burden separated by your disgusting monthly earnings. A lesser DTI proportion normally makes you more inviting to help you loan providers, exhibiting you have an excellent balance of cash and you may obligations that will allow that pay the mortgage.

Good credit get

Good credit are an elementary significance of obtaining good house collateral mortgage. A premier credit history (620 or maybe more) suggests to lenders you have consistently handled your credit for the during the last and are generally ergo less likely to default towards the costs. Here are some tips on precisely how to improve home loan FICO get prompt.

Monetary papers

Loan providers commonly demand many monetary data to evaluate your financial situation and you can confirm your earnings. Latest shell out stubs, tax statements, financial comments, proof of work, and you may funding account statements try instances. It’s also possible to need the newest financial report and you may facts away from homeowner’s insurance coverage for any present mortgage brokers.