Financial Interest levels with a 650 Credit score

Solely available to veterans, active military professionals, and their spouses, Virtual assistant finance give many perks, plus zero down payment, lower rates of interest, shorter closing costs, while the absence of individual mortgage insurance coverage.

I have believed the house financing cost of $three hundred,000, you should check the interest cost according to home loan number.

Ought i Score an unsecured loan which have an excellent 650 Credit rating?

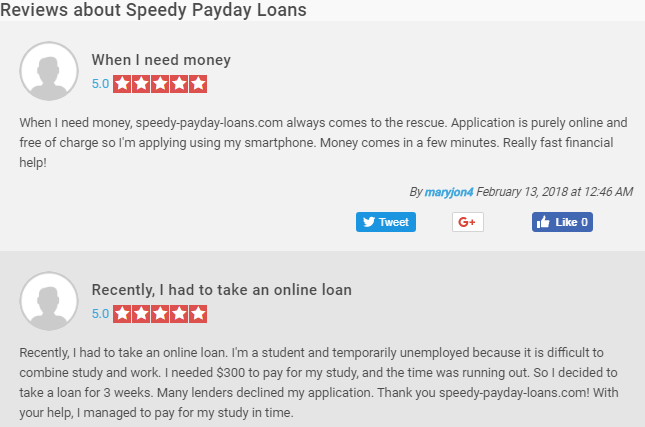

You can in reality get a personal loan which have an effective 650 credit get, and you will money appear even with ratings less than 650. If you’re a get out-of 550 or even more is expected, for every bank has its own requirements. An excellent 650 rating grows your odds of approval, although the terms is almost certainly not an informed loans Pisgah AL.

Interest levels usually range between % so you can %. To have better words, imagine launching an effective co-signer or shared debtor which have a healthier borrowing profile and higher earnings.

Techniques for Boosting an excellent 650 Credit history

Energy spent wisely contributes to rewarding results. That said, with some focused efforts, you could potentially change your rating and you may increase accessibility better economic solutions.

- Make ends meet promptly

- Eliminate mastercard balances

- Check your credit report to possess mistakes

- Simply take assistance from a card fix app

- Limit the borrowing apps

- Pay back current obligations

- Improve credit constraints

- Care for a mixture of borrowing products

- Remain dated credit accounts unlock

Boosting your credit rating above 650 opens up the door to better interest levels into the a variety of funds. Read the dining table below to see how much cash you could cut!

End

To sum up, an effective 650 credit score may not be prime. However, it is a substantial first step that bring the means to access credit and you will pave just how getting economic increases. From the acknowledging exactly what your credit history means, and you can leverage its strengths, you might with full confidence navigate the credit landscaping and move nearer to achieving economic triumph.

Moreover, that have good 650 rating, there clearly was more than enough room to own development, and you will CoolCredit makes it possible to get there. Which Diy borrowing resolve app provides all you need to raise your credit rating, away from AI-made conflict emails and borrowing from the bank overseeing to advance record and you can academic devices. On the other hand, you could potentially select possibilities such as for example Totally free Diy borrowing repair or Expert assistance.

Q: Are good 650 Credit score An excellent?

A: An excellent 650 credit rating is reported to be from the „fair” range, and thus it’s not crappy, however it is and additionally maybe not sophisticated. While it can get meet the requirements you for sure fund, playing cards, and you will financial products, you will possibly not get the really positive interest levels or terms and conditions. Lenders get consider an effective 650 rating while the a bit high-risk, so you might face large will set you back over the years versus individuals having increased get. Although not, which have responsible monetary conclusion-like expenses expense timely, cutting personal debt, and you can avoiding the credit issues-you could potentially change your get and discover most useful financial options during the the long term.

Q: Exactly how much away from a home loan Ought i Get with good 650 Credit rating?

A: The amount borrowed hinges on certain activities, together with your money, debt-to-earnings ratio, and the brand of mortgage you might be obtaining. As you ounts or even the best rates, improving your credit score by way of fast payments and you may cutting existing obligations you can expect to enhance your borrowing electricity and you may secure ideal conditions regarding coming.

Q: How much cash Should i Obtain Having a credit rating Not as much as 650?

A: In the evaluating the loan app, finance companies browse outside the credit score. It remark your revenue and you will costs understand just how much you can afford to pay-off. While your credit score affects the pace you receive, the true amount borrowed is basically influenced by debt balance and you may cost potential.