For many who bring your account latest inside the forbearance, your own mortgage servicer need to report the mortgage given that latest

not, it can be true that the loan is not instantaneously federally recognized and therefore does not be considered in CARES Act up until it gets federally supported, that will get days or perhaps in some instances weeks

- Setting up a payment plan who would pass on their skipped money over a designated level of months, which may improve monthly payment before the overlooked forbearance repayments were totally paid down and you will could be predicated on your ability so you can result in the the brand new monthly premiums.

- Extending the term of one’s loan for the majority length of time to spend right back new overlooked costs. For example, when the considering a six-few days period for which you do not make a mortgage percentage, your own home loan servicer can truly add half a year regarding money to brand new big date in the event the mortgage is defined getting repaid (the new maturity go out).This would be that brand of that loan modification.

- Changing your loan to catch in the overlooked repayments over the years as a consequence of a selected modification program provided by the master of their mortgage.

Note: Any loan mod once the forbearance identity will most likely require their servicer so you’re able to file your earnings and you will costs to ensure your meet the requirements to have a modification system. The newest servicer often contact you regarding it prior to the avoid of the forbearance period.

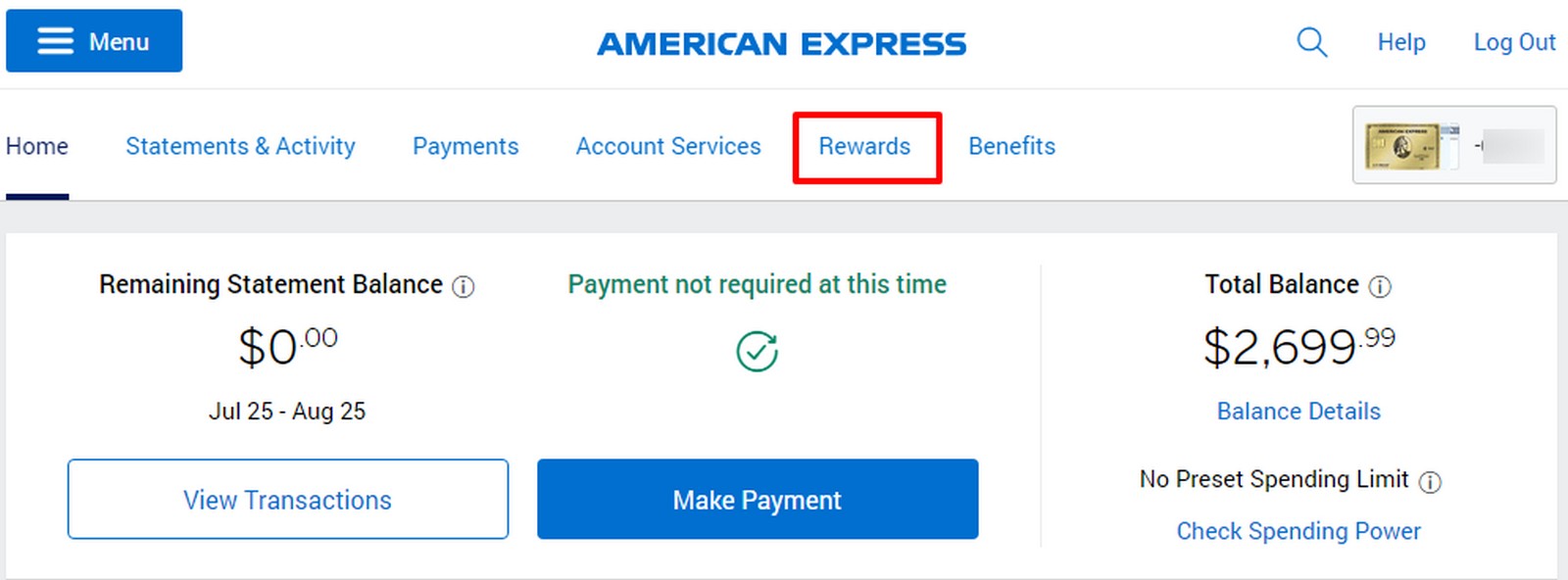

You will want to arrange a great forbearance that works for you. To arrange to call their mortgage servicer for a great forbearance request, you should assemble your bank account suggestions. You could opinion in public offered mortgage servicer name programs making sure that you should understand the kinds of concerns your servicer will get inquire when discussing forbearance that have youmonly utilized label programs and financing files include:

But not, it can be true that the loan isnt quickly federally backed which will not be considered in CARES Act up until it becomes federally supported, that will get weeks or perhaps in some instances days

- Federal national mortgage association Forbearance Name Software: Link

- Freddie Mac COVID-19 Telephone call Script: Hook

- FHA COVID-19 Inquiries and you can Responses: Hook

- Virtual assistant Round twenty six-20-12: Hook up

In the event the mortgage is eligible getting rescue and you are clearly which have pecuniary hardship due to COVID-19, youre eligible to all the way down costs or forbearance that is provided regarding the CARES Act. While you are nonetheless capable of making your own complete monthly payment, it is possible to desire to remain doing this while the focus continues to grow as the arranged and at some point need certainly to pay-off brand new quantity of one forbearance.

Whenever sharing forbearance with your home loan servicer, make sure to explore all repayment available options for you before entering a forbearance program. Payment choice may differ according to the loan method of, and you’ll discover in advance of typing forbearance how you will getting expected to pay back their paused repayments.

For many who and your servicer disagree into forbearance relief alternatives, and don’t forget the CARES Operate entitles one a great forbearance https://paydayloanalabama.com/edgewater/ all the way to 180 weeks at your request, and you will an extension regarding an additional 180 days at your demand. Continue detailed cards in your discussions and look any files delivered by your servicer to make sure the fresh regards to your forbearance are obvious.

Lenders are currently requiring the brand new borrowers to help you indication COVID Attestations verifying one to income has never changed and they are not aware of coming changes in work or the need demand forbearance. Loan providers may also let you know that your particular financing isnt quickly federally supported and this cannot qualify for CARES Operate forbearance.

This doesn’t mean you try not to consult forbearance information and you can of a lot lenders and you will servicers are providing forbearance benefits despite federally backed standing. For those who have recently signed towards the that loan and already find yourself in need of assistance, you need to speak to your servicer to decide the options.

The brand new CARES Work also covers you against certain negative information regarding your credit report because of any home loan save or guidance related on the COVID-19 emergency. Within the months protected by the brand new CARES Operate, the latest CARES Act needs the financial servicer to statement your bank account since the newest in the event your membership are newest in the course of the fresh forbearance incase your meet with the terms of your own home loan relief; or if your account is outstanding through to the COVID-19 emergency, to maintain a similar unpaid position.