Generate Yourself Lot during the Texas that have a keen FHA / Virtual assistant Framework Loan

The latest FHA and Virtual assistant You to definitely-Big date Intimate funds try framework-to-long lasting mortgage loans, both of which are very important options to thought if the beginning with a brand name-new house is the advice youre going. Usually the one-Go out Romantic program lets licensed individuals inside Colorado to use a great unmarried closure to invest in the build of the property and you may the fresh long lasting money. The price of the new residential property is also financed for those who do not currently own it. But when you do, lot equity can be rolled inside the. Even although you provides a good lien resistant to the package, it would be repaid and set in the latest notice.

Zillow periodically tracks construction style and has shown home-based growth in of several areas on state that is always to remain into forseeable future. The fastest expanding Tx urban centers are Austin, Cedar Park, Conroe, Denton, Frisco, Foot. Worthy of, Georgetown, Houston and you will Leander. A lot of people throughout these metropolises are choosing to create their home in place of doing your research if there is little so you can select.

- Down repayments for qualified pros aren’t needed. $0 down payment money up to $1,five hundred,000 could be offered.

- Off payments for FHA borrowers as low as step 3.5%. 2024 Credit limits for the majority of Colorado areas commonly maximum out from the $498,257, however go as much as $571,550.

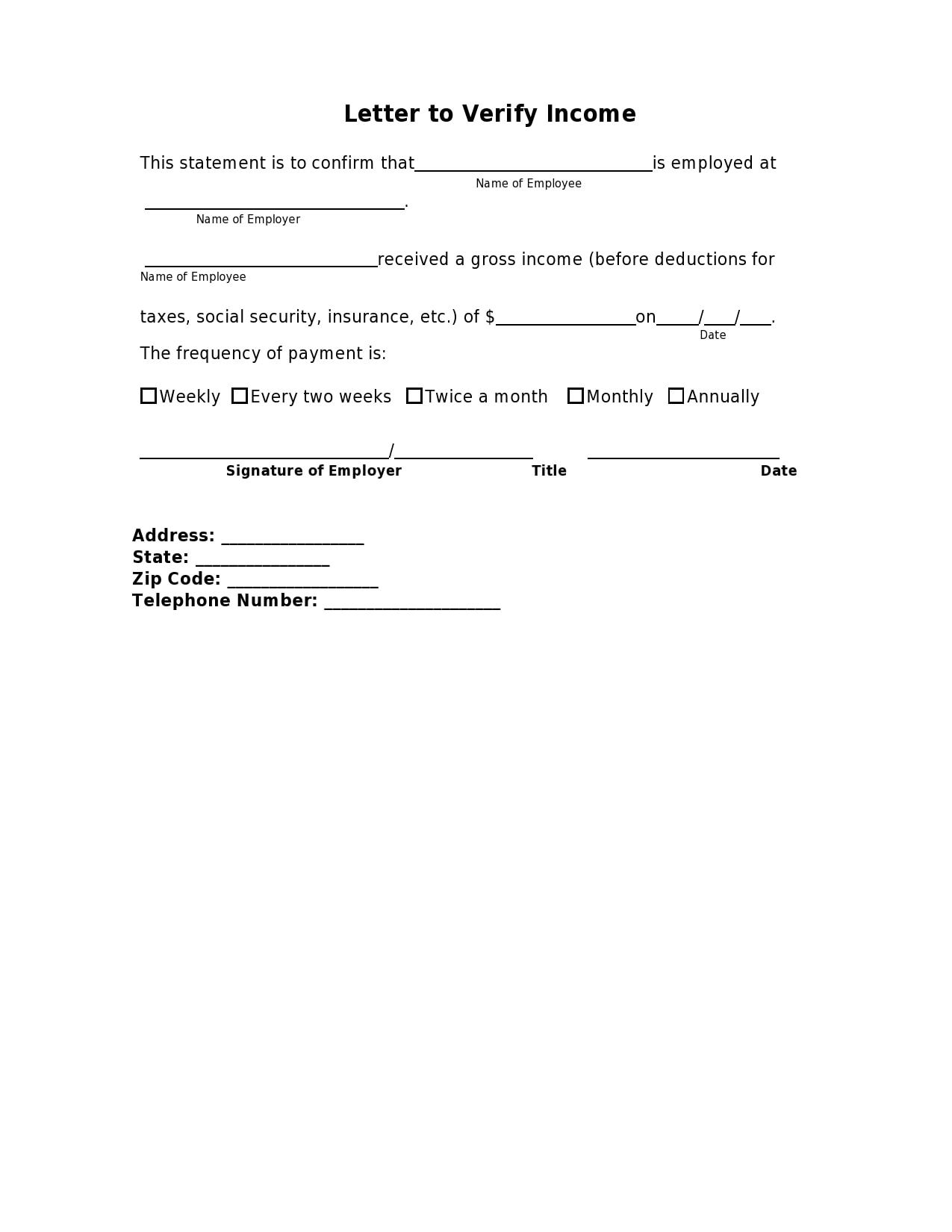

- Just be sure to be sure 2 yrs out of uniform work.

- An effective „middle rating” from the 3 credit reporting agencies out of 620 or top required.

- The debt-to-earnings ratio measures your own housing and you may much time-name financial obligation against your income. It should maybe not go beyond 41% – 43% and you can varies from that government agencies to another.

You could finance the stick-mainly based, modular, otherwise twice-large were created casing that have a one-Day Romantic loan in just about any of the 254 areas in Texas. Remember that so it build credit program can just only become utilized for single family land, not to possess duplexes, triplexes, otherwise fourplexes. Trader qualities aren’t desired, and you also cannot be the your creator.

I have over thorough look on FHA (Government Casing Management) and Virtual assistant (Agency from Experts Activities) One-Time Intimate Design loan https://paydayloancolorado.net/minturn/ applications

Whenever framework in your home is complete, there may not another type of borrower requalification or a beneficial recertification of the home well worth. And you can until that time, home loan repayments cannot initiate.

A switch advantageous asset of one-Go out Personal loan program is the fact consumers simply sense one home loan software, one financial recognition, and you will a single closing datepare by using more conventional items that function a couple of per and a more challenging process

If you are looking to have a home that suits your loved ones, existence, and you may future need, strengthening could well be a far greater bundle than to acquire. Manage yourself a benefit and you will consider this option before making probably one of the most important decisions that you experienced.

I’ve verbal straight to licensed lenders you to originate such domestic loan items in most claims and each organization provides supplied all of us the principles for their issues. We are able to hook your having real estate loan officials who do work to possess loan providers you to know the tool really and just have constantly given top quality service. When you find yourself interested in becoming contacted by an authorized financial towards you, please post solutions into concerns lower than. All of the data is addressed confidentially.

OneTimeClose brings information and you may connects consumers in order to qualified You to-Big date Intimate loan providers to raise awareness about any of it mortgage unit and you can to simply help people discover higher quality service. We are really not covered promoting otherwise recommending the lenders otherwise financing originators and don’t if not make the most of this. People is always to buy home loan functions and you may examine their selection ahead of agreeing so you’re able to go ahead.

Take note that investor guidelines on the FHA and you will Virtual assistant You to definitely-Date Close Design System simply allows for single family homes (step 1 product) rather than getting multi-members of the family devices (no duplexes, triplexes otherwise fourplexes). On the other hand, the next house/strengthening looks are not greet below this type of programs: Kit Land, Barndominiums, Vacation cabin Land, Shipment Container House, Stilt Belongings, Solar power (only) or Wind Powered (only) Home.

Excite upload their email request so you can [email safe] and that authorizes OneTimeClose to generally share a pointers that have that home loan lender authorized in your area to get hold of your. 1. Post the first and you may past title, e-mail address, and make contact with telephone number.

3. Inform us your and you may/or perhaps the Co-borrower’s borrowing from the bank reputation: Excellent (680+), Good – (640-679), Fair (620-639) otherwise Terrible- (Below 620). 620 ‘s the lowest being qualified credit rating for it device.

4. Have you been otherwise your lady (Co-borrower) qualified pros? When the either of you qualify veterans, off repayments only $ount your debt-to-money proportion for every single Va enable there aren’t any limit financing amounts according to Va recommendations.

Very Va loan providers goes around $1,five hundred,000 and you can feedback high mortgage numbers on an instance-by-situation base. If not, the latest FHA down payment is actually step 3.5% up to the most FHA credit limit to suit your state.