I decided to go to a private college and you can racked up debt We didn’t understand

- Because of the pause for the student-loan payments, I spared tons of money to possess a deposit.

- But now they are creating again, I can no further save your self getting a home.

- I need to create loads of hard s towards the keep.

For decades, my personal $thirty-five,000 financial obligation strung more my personal direct. Whenever I got myself a product I desired, We questioned if or not I should help save those funds for my personal payments. When i gone rentals within the New york, We concerned I would be refuted because of my debt.

But one to altered in the event the government paused loan repayments and fell the eye pricing to 0% in the midst of the brand new pandemic. I decided I could inhale.

Over the past 3 years, I happened to be in a position to fundamentally place my places to your future. However now that repayment pause is originating so you’re able to an end, I have to lay my preparations towards the keep and you can anticipate right back my monetary nervousness.

I became like any higher-college or university seniors: thrilled to access an informed college I’m able to and start living given that a grown-up. I remember many people advising me to consider county colleges, but We decided I experienced to visit a good prestigious private school to attract visitors.

I was not thinking about my upcoming care about as well as the financial obligation We perform deal with immediately following graduation. You to definitely coming worry about felt like a dream; I didn’t envision me once the a grown up-upwards using expense, so what did it number if i visited a school We failed to pay for?

I enrolled in Emerson University due to the fact a news media big. On account of my family members’ financial predicament, We gotten has you to taken care of most my tuition. I found myself still left which have a hefty statement through to graduation.

After college or university, I paid off my month-to-month minimal and noticed grateful in the event that money was indeed paused

Whenever i graduated inside 2015 and arrived my personal earliest complete-go out employment, I was and make only about $55,000 a year. Residing in New york city, I was able to pay-rent and you can eat out two of times a week.

But then my personal student-loan-commission sophistication several months involved an end, and i also had to start settling my $35,000 loans. We panicked. Luckily, We was not and then make this much money, so i was required to only pay on $100 1 month once the I was into the a full time income-determined package.

If the 2020 stop become, I found myself eventually able to settle down. With that statement on the rear burner, I can remember my personal cash in another way.

We reach build a smooth existence and plan for my coming

For the past 36 months, I have obtained numerous introduces. Since i have didn’t have one student education loans to pay off, We already been rescuing – a great deal.

I imagined getting a condo someplace in Florida and number they toward Airbnb. It decided the perfect investment opportunity, plus the entrepreneurial element delighted me.

I knew I desired at least $31,000 to cover the an advance payment. Since i have worried about saving and had the additional currency as opposed to my personal mortgage money, I was capable of getting close. I found myself in a position to put my profit behind a dream I is enthusiastic about.

And additionally, inside the 2022, Chairman Joe Biden revealed his policy for student-loan forgiveness. Under you to plan, an astonishing $20,000 from my personal loans would’ve been damaged. That have much reduced obligations, I knew it would be simpler to get a home loan, and that i you can expect to set my personal discounts with the my Airbnb package.

My personal college student-financing payments are starting once again, plus they are triple the price

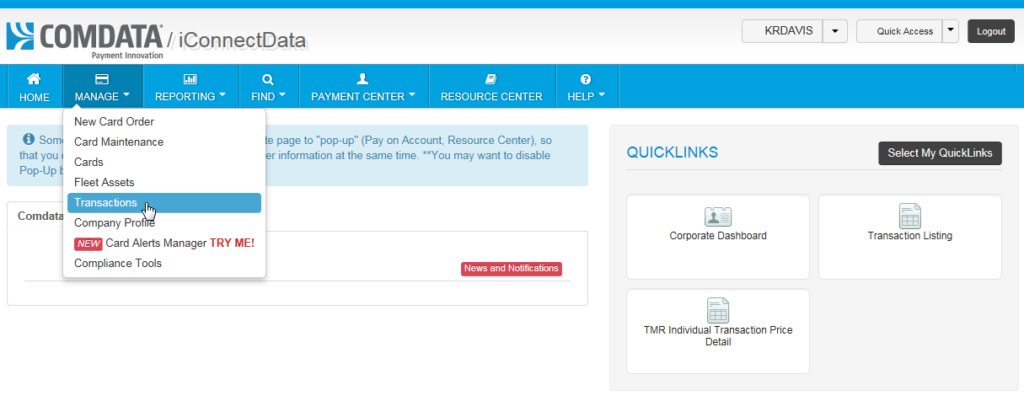

The other day, I logged towards the and you may put on the fresh new Save program, looking to get the brand new $100 monthly obligations I was investing up until the pandemic. Which was a good fool’s fantasy.

Since i have now generate way more money than I became till the pandemic, my personal costs popped so you’re able to $350 a month. Whenever i spotted the quantity, I found myself shocked. The common worry payday advance loans Weston CT crept back into.

I pondered: Exactly how will i afford one? As to the reasons did not We save money particularly for my money when you look at the stop? As to why did I go in order to an exclusive university in the first set?

I am today obligated to place my fantasies to your keep to pay right back my personal finance

After my personal worry subsided, I got to obtain real that have me. I live on a tight finances. Every penny I do not invest in basics went for the my coupons for this domestic. Since extra money will go on the my personal $350 money.

Which means I’m protecting little to no money to own my future; thus, I won’t achieve the $29,000 objective Now i need having a down-payment.

I contended having fun with the currency We secured across the previous long time to repay my personal student education loans and then carrying out once more to get results toward a down-payment. But really, you to package depresses me-too far. I additionally argued making the position I adore much only to locate paid back more. We have also considered getting an extra business.

I don’t have people solutions but really, however the scary the truth is I will need certainly to lay my personal desires on hold.