Record Retention New York, NY

Efficiently managing goods in transit is crucial for businesses to maintain accurate financial records and ensure smooth operations. This process involves tracking items that are being transported from the seller to the buyer but have not yet reached their final destination. Effective transit inventory management is crucial for optimizing supply chain operations, reducing costs, and enhancing customer satisfaction. When goods are in transit, they represent an asset that must be accurately reflected in the financial records. Mismanagement or misreporting of these assets can lead to distorted financial health indicators, which can mislead stakeholders and investors.

Record Retention for Businesses

We translate complex financial concepts into clear, actionable strategies through a rigorous editorial process. Toyota’s Kanban system is a just-in-time (JIT) inventory management approach that minimizes transit inventory by coordinating production with customer demand. The system uses Kanban cards, which are visual signals that trigger the production or movement of goods.

Which of these is most important for your financial advisor to have?

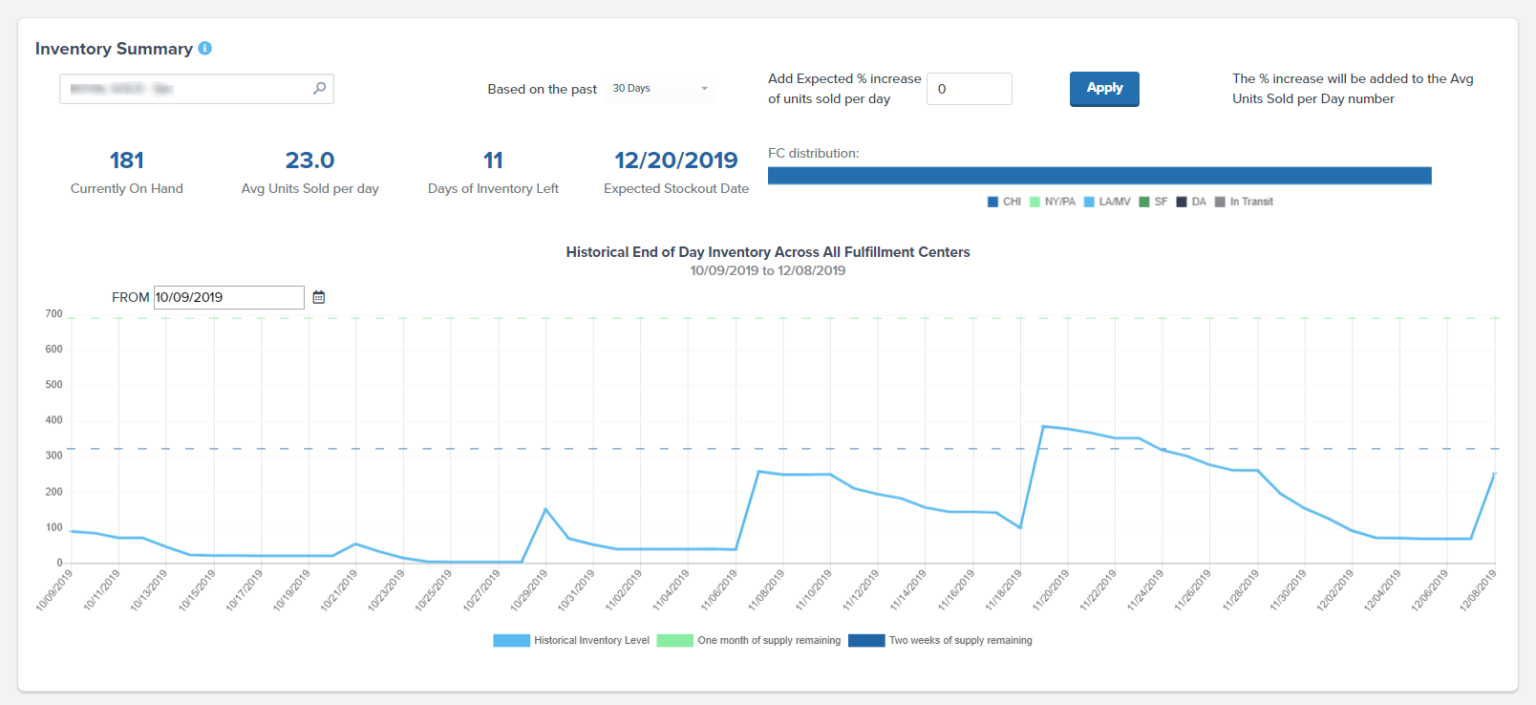

Even with helpful inventory management softwares, it can be tricky to keep track of all the comings and goings—especially if some of your inventory hasn’t physically arrived yet. Along with ownership, the risk and responsibility for the inventory also transfer. This temporary state of inventory occurs during the transportation phase of the supply chain, bridging the gap between the seller’s warehouse and the buyer’s receiving dock. Finally, add this cost to your average inventory shipment to arrive at the total cost of your in-transit inventory. The accounting of goods in transit shows whether the seller or buyer owns the goods and who paid the shipping costs. There is usually an agreement (shipping terms) between the seller and the buyer on who records these goods in their accounting records.

Would you prefer to work with a financial professional remotely or in-person?

- This misstatement can have a cascading effect, influencing operating income and net income, thereby affecting the overall financial performance of the company.

- Additionally, understanding trade agreements between countries can provide opportunities for tariff reductions or exemptions, further optimizing the cost structure.

- Let us take an example in which SDF Inc. is the seller, and BDF Inc. is the purchaser.

- Normally, there is an organization (dispatching terms) between the vendor and the purchaser with respect to who should record these items in the accounting records.

- In this case, the same transactions occur, but on December 2 instead of November 28.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

Often when a business is starting out the owner will rush to quickly get all the right policies in place in time for the official launch. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Reducing Lead Times

Managing expectations throughout the supply chain plays a massive role in reducing product returns and customer support tickets. Therefore, when goods are shipped to the FOB shipping point, the title passes from the seller to the buyer at the shipping point. From a legal standpoint, the title passes from one party to the other when the goods reach the FOB point. These goods are easily overlooked when counting the ending inventory because they are not physically located at either the seller’s or the purchaser’s warehouse. In short, goods in transit indicate at the time when the label of possession and threat goes from the vender to the purchaser.

Let us take an example in which SDF Inc. is the seller, and BDF Inc. is the purchaser. SDF Inc. ships merchandise worth $50,000 on January 15, 2020, and it is yet to reach BDF Inc. Determine which company should record the goods in transit in their accounting books if the terms of the delivery freight are on board (FOB)shipping point.

If the terms are FOB shipping point, the company (seller) will record a sale and receivable as of December 30, and will not include the goods in transit as its December 31 inventory. On December 31, the customer (buyer) is the owner of the goods in transit and will inventory in transit accounting need to report a purchase, a payable, and must include the cost of the goods in transit in its inventory cost. By following these best practices, you can enhance your management of in-transit inventory, reduce risks, and improve overall supply chain performance.

For a lot of businesses, storage will cost around 15% of the inventory purchase value. The other type of inventory classification is “FOB destination,” in which ownership transfers to you when the items arrive. In this scenario, the seller owns (and is liable for) the in-transit goods until you receive them. For goods in transit accounting, the foremost problem to answer is if a deal has occurred, bringing about the entry of title to the purchaser.