Regarding the underwriting processes to possess an interest rate, there are stages one to consumers have to browse

Among crucial steps in it journey was obtaining conditional acceptance, followed closely by finally loan acceptance. Such milestones denote significant advances to your protecting the mandatory money and sooner or later to-be a homeowner. In this section, we are going to explore the newest ins and outs of conditional approval and final mortgage approval, shedding light on what they involve and just how they sign up to the general underwriting processes.

Conditional acceptance is a vital milestone from the underwriting process, appearing the lender try willing to move forward on the application for the loan, subject to certain criteria getting satisfied. This stage normally happens adopting the debtor keeps registered all required papers and you can experienced an extensive evaluation of the underwriter. The fresh conditions established because of the bank may vary depending on the particular facts of the borrower, nevertheless they basically rotate as much as verifying information, making clear discrepancies, otherwise getting a lot more paperwork.

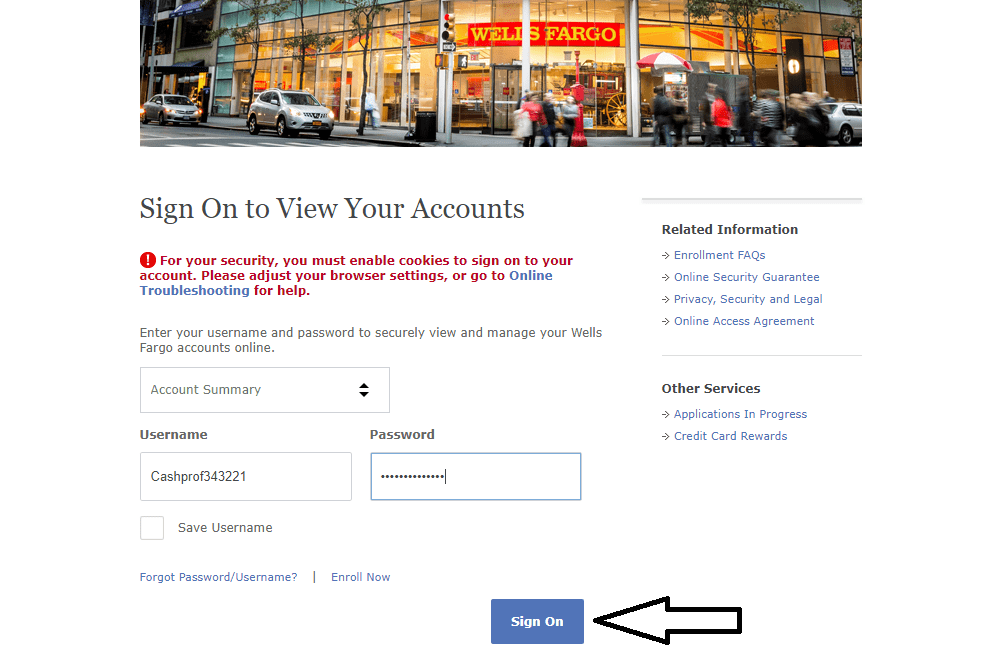

For example, let’s consider good hypothetical circumstances where a debtor provides removed an interest rate. Shortly after evaluating the program and supporting data, the fresh new underwriter can get question a conditional recognition, contingent abreast of the newest borrower delivering updated lender comments over the past 3 months. In this case, the fresh debtor will have to fulfill this problem ahead of continuing so you can the next stage of the underwriting procedure.

From inside the conditional acceptance stage, lenders commonly demand additional records to guarantee the borrower’s monetary character aligns due to their financing conditions. Some traditional criteria are evidence of money, a career confirmation, asset comments, credit grounds, plus. It is crucial to have consumers so you’re able to timely supply the expected documents to end delays about underwriting process.

Including, if the a debtor has just changed perform, the financial institution may require a letter regarding factor and you may employment verification about new workplace. By satisfying this condition, new debtor is have shown balances and you may guarantees the financial institution of the ability to pay back the mortgage.

Meeting the brand new requirements established during the conditional approval is vital to possess moving forward to your latest mortgage approval. Incapacity in order to satisfy these conditions can lead to delays otherwise assertion of loan application. What is very important getting consumers to find out that conditional approval are not a vow from final approval; it really shows that the lender is actually prepared to go ahead having the program when the what’s needed is came loan places Brundidge across.

To help you teach this point, let’s consider a situation in which a borrower obtains conditional approval however, doesn’t supply the expected files in the specified schedule. Thus, the financial institution is generally unable to make sure crucial guidance, leading to an assertion of the application for the loan. Ergo, individuals would be to vigilantly address the new conditions to ensure a softer change to another phase.

Last mortgage acceptance ‘s the holy grail of the underwriting procedure. That it phase happens at all requirements was basically came across therefore the lender keeps very carefully analyzed the new borrower’s financial character.

Given that underwriter are satisfied with brand new borrower’s certification, they material the final loan approval, signaling your mortgage is able to proceed so you can closing

This type of affairs make sure the security suits this new lender’s standards and you can that we now have zero legal issues impacting the house.

It’s important to observe that final loan recognition was contingent abreast of various facts, such as the property appraisal, identity lookup, and you may any additional criteria specific for the mortgage program

Underwriters enjoy a significant part in conditional recognition and you can last financing approval. It carefully remark the new borrower’s economic files, credit rating, or any other associated information to evaluate their qualification with the financing. Underwriters act as gatekeepers, making certain that financing guidelines try adopted and you may mitigating threats towards the lender.