What’s the Escrow out of property?

Holds usually are awarded for the escrow. In this case, since the stockholder ‘s the genuine manager of your own stock, the latest shareholder possess minimal rights in terms of brand new discretion of your own stock.

Such, executives who discovered inventory once the a plus to their payment tend to must wait for an enthusiastic escrow period to pass just before they may be able promote the newest inventory. Stock incentives can be used to attention or preserve most readily useful professionals.

Escrow an internet-based Transformation

https://elitecashadvance.com/personal-loans-il/chicago/avant/

On line escrow, including a property and stock-exchange escrow, covers the customer and you will supplier off fraud otherwise nonpayment. An online escrow provider will act as the 3rd group getting on the internet marketing. Consumers send their repayments for the escrow service, which keeps the money till the device is acquired.

While the device is brought and you can confirmed, the web escrow service releases the money with the provider. Escrow characteristics might be best fitted to large-value factors, instance accessories or ways. The web based escrow business charges a charge for the service.

You could potentially demand a keen escrow account oneself to the taxation and insurance policies costs in your house, although your own financial has no need for they. Escrow will help a home owner make sure that currency necessary to possess possessions fees and insurance rates would-be readily available when commission try owed. Quite simply, in the place of being forced to developed an enormous lump sum payment, the homeowner produces less month-to-month deposits into the a keen escrow membership, and that is disbursed because of the broker from the appropriate moments.

Advantages and disadvantages out of Escrow

Escrow accounts for mortgages can help cover this new borrower and you can financial out-of potentially later repayments for possessions taxes and you may home insurance. Such month-to-month numbers are estimated. You could potentially overpay (otherwise underpay) into the escrow account, which may need a change when it comes time with the servicer to help make the repayments.

Instance of Escrow

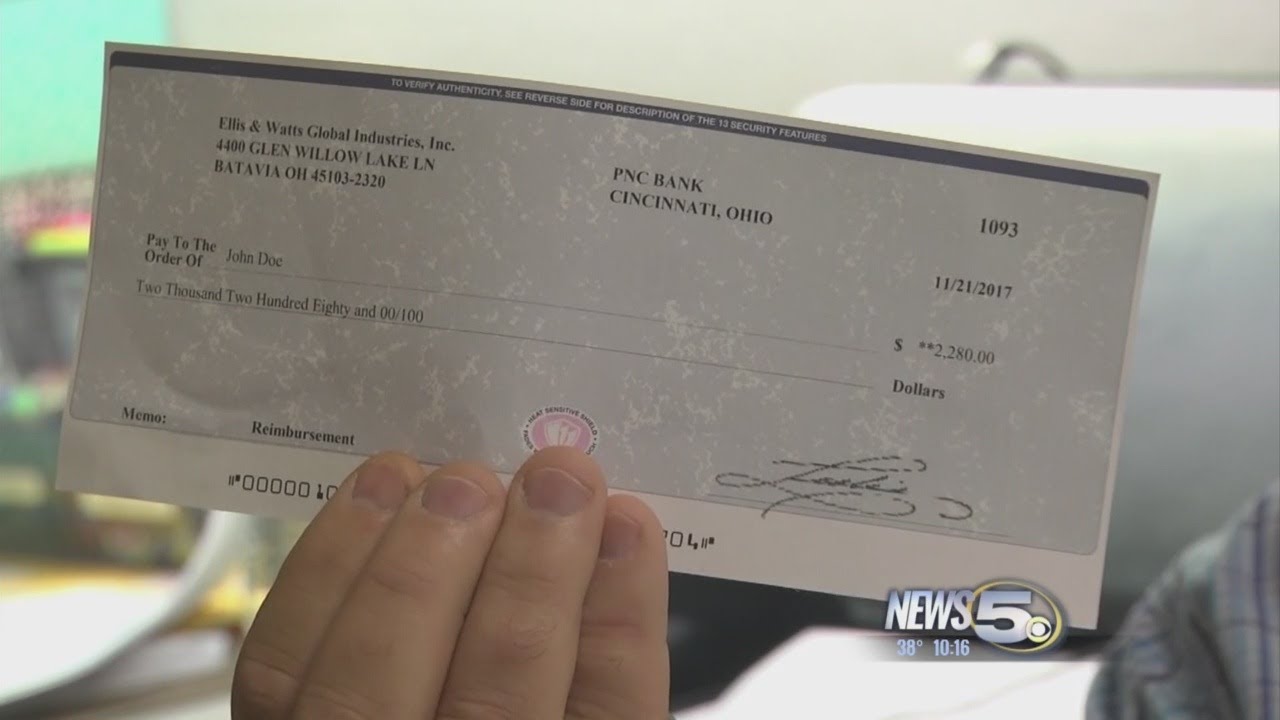

Homeowners usually play with escrow double. First, since serious currency right after which, during the closing. Claim that John desires buy a home. He finds out a property and you may chooses to make an offer. The deal is approved in which he must lay earnest money off $5,100 on escrow.

The bucks installed escrow reveals the seller one John was serious about purchasing the property. In return, the vendor takes the house off of the sector and finalizes fixes, etc. Every happens well and at committed of choose the escrow money is gone to live in the vendor while the cost is faster because of the $5,100000.

At the closing, John believes to set up a keen escrow account into financial to blow assets taxes and you can home insurance. John’s monthly payments look like it:

- $1,000 having prominent and notice

- $100 having homeowners insurance

- $3 hundred to own possessions taxes

- Complete month-to-month mortgage repayment out-of $1,400

After that, in the event the yearly taxes and you can insurance money is due, the lending company means they are playing with cash in the fresh escrow membership. Some lenders need an enthusiastic escrow membership in order that both of these are paid down promptly. If the taxation wade unpaid, the new income tax authority you may put an effective lien to the assets, that is not regarding best interest of one’s financial.

Escrow according to to shop for property are a merchant account (known as escrow membership) in which funds from the potential homebuyer is actually transferred. Necessary escrow are step one% in order to 2% of selling price getting a home. The money must make sure the buyer are absolutely given your house and has the amount of money to make the pick. Reciprocally, the vendor will usually make property off of the business and you will let the possible consumer accessibility your house having checks.